Drugs, gambling, and prostitution are not included in inflation. But what is? How is inflation calculated, and which products are getting more expensive? Analysis.

Inflation is in the news and regularly discussed on social media platforms now. Banks are raising interest rates, people are buying chicken breasts like there is no tomorrow, and everyone is experiencing rising prices. We hear all sorts of tips from many sources about what to invest our money in, but few people know what exactly inflation is and what it really means.

Inflation and the consumer price index

For an average consumer, inflation is the rate of increase in prices over a year, expressed as a percentage. For the same €6, a year ago we could buy a whole lunch, now we get just a small portion of soup. Everybody knows from their family history that 50 years ago, our grandmothers paid a hundred times less for a loaf of bread than what we pay today.

Inflation is not always a problem. There is inflation, and prices rise in normal times too; the interesting part is the extent of the increase. High inflation affects the average cost of living, ultimately leading to a slowdown in economic growth. Inflation can be contrasted with deflation, which occurs when prices decrease due to people having less money at their disposal. So, we can look at inflation and deflation in terms of how much money is on the market or how much money is circulating among people. The more you have of something, the less valuable it is to you. A good illustration can come from the garment industry: fast fashion clothes are relatively cheap, while designer products have very high prices. If everyone has a lot of money, no one has a lot of money since our currency is worth less and less then.

However, experts say other factors are behind the high inflation now. The extreme price rises are not because there is too much money in the economy. We are still recovering from a global pandemic, and we can still not see the end of the Russo-Ukrainian war. These two events have serious economic consequences for the whole world. Supply chains have been disrupted because of the war in Ukraine and the worldwide lockdowns, so it is harder to get certain goods. This leads to a general increase in the prices since if there is less from something, it becomes more valuable. According to Eurostat, the main driver of inflation in Europe is soaring energy costs, which rose 44.7 percent last month, up from 32 percent in February. Oil and gas prices had already risen before the Russian invasion due to the growing demand of economies recovering from the COVID-19 recession.

What makes up inflation in the EU statistics?

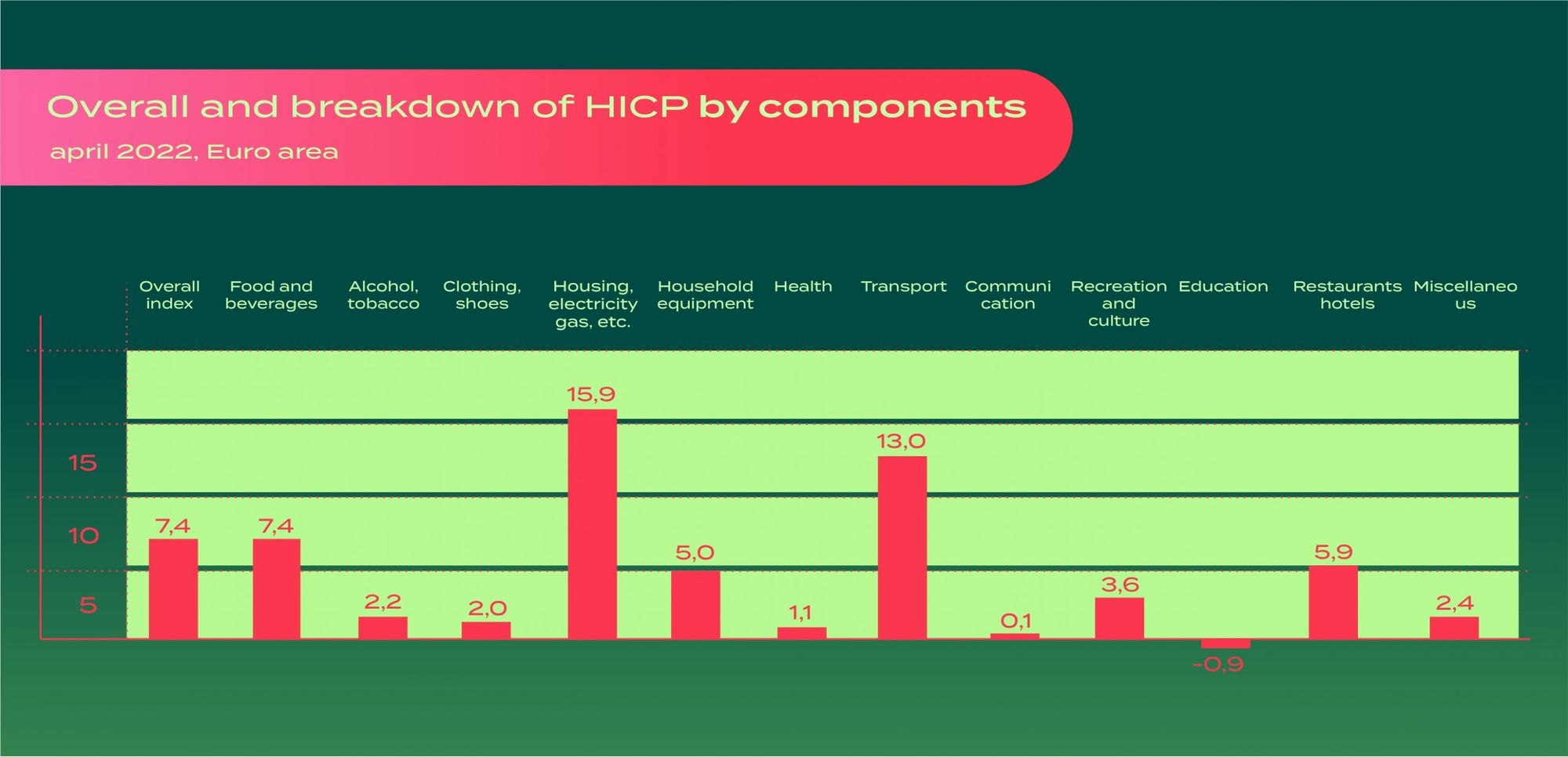

Inflation is usually calculated with the consumer price index. In the euro area, Eurostat calculates it every month by using the Harmonised Index of Consumer Prices (HICP), which measures the changes over time in the prices of consumer goods and services acquired by households in each country. Harmonized means that all countries calculate it with the same methodology, otherwise, it would make no sense to compare them. The HICP covers approximately 700 different goods and services. So, it includes almost everything except drugs, gambling, prostitution, life insurance, public health insurance, and a few other similar categories.

Do we need to worry?

The countries’ responsible monetary authorities, such as central banks, are trying to tackle inflation. They take all the necessary measures to keep inflation within acceptable limits and ensure that the economy runs smoothly. These efforts can be seen, for example, in the European Central Bank’s recent decision to raise interest rates in July for the first time in 11 years. But what is the purpose of raising interest rates? In simple terms, the higher the base rate, the more advantageous to keep our money in the bank. So, there will be less money in the economy, and people will spend less, resulting in declining demand for certain goods. The price of these goods will fall in line with the demand, thus moderating inflation. At least, this is how it should work in theory if there are no external factors.

Some items have become cheaper

We can read about threatening percentages and extremely high numbers on the internet regarding inflation. As a benchmark, it is important to note that the European Central Bank (ECB)’s medium-term inflation target is 2%, just as those Central and Eastern European countries’ that use a different currency. The Fed, the central banking system of the US, also considers 2% to be the ideal rate of price increases.

In the eurozone, the cost of housing, water, electricity, gas, and other fuels skyrocketed the most in recent months. That gas and other fuel prices increased is not surprising in the light of the Russo-Ukrainian war, but that they have risen at more than twice the rate of food prices is still shocking. Energy prices are followed by transport, while communication costs increased the least. Surprisingly, the prices of services and goods connected with education have not increased at all; on the contrary, they have decreased by 0.9% compared to the previous period.

In most CEE countries, there are no outlier categories; the only exception is Estonia, with a 62.3% price increase for housing, water, gas, and other fuels. The central bank of Estonia (Eesti Pank) acknowledges that the country’s economy has been severely affected by the Russo-Ukrainian war. As a result of the invasion and the sanctions, natural gas prices rose by 87 percent, heating by 58 percent, and electricity by 29 percent. All Estonians feel these consequences. Interestingly, according to the Eesti Pank’s latest forecast, inflation will be 15.1 percent this year in the country, barely less than in Ukraine, where the State Statistics Service of Ukraine expects a 16.4 percent price increase. Within the margin of error, the figures can be equal. Fortunately, not all countries have seen such a price jump; the average inflation rate in the euro area was 7.4% in April compared to the previous period, with the CEE region ranking in the middle. There is little that can be done with the current high inflation, but we can hope that the prices will go down, stabilizing the market in the long term, and the present chaotic economic situation will improve to some extent.

Csepel gets a new identity and website

Thanks to Airbnb, anyone can spend a night in the Scooby-Doo van