What happens when the art market stops chasing records and starts focusing on survival strategies instead? In 2025, the global art scene became simultaneously more cautious, more fragmented, and surprisingly pragmatic. The question is no longer what the next big hit will be, but rather which direction a market can move in while trying to remain relevant, liquid, and culturally credible at the same time.

For a long time, we liked to talk about the art market as a separate universe—one where prices were detached from reality and paintings offered safer refuge than any bank. But 2025 was instead about what happens when this universe suddenly becomes very much grounded. Fewer records, more waiting, more cautious collectors—and, at the same time, a handful of spectacular sales that served as reminders that the market hasn’t died; it has simply begun operating according to a new logic.

Fewer Records, More Control

According to the Art Basel & UBS Art Market Report 2025, the global art market’s total turnover declined further compared to the previous year, particularly in the highest price segments. The number of works sold above $10 million decreased, and the report emphasizes that it is not demand that has disappeared, but rather risk appetite. Collectors—especially in North America and Europe—are selecting more deliberately than ever, and are only willing to pay extreme sums for works backed by unquestionable art historical significance, rarity, and impeccable provenance.

This trend has been confirmed by the major auction houses as well. While the speculative segment of contemporary art slowed dramatically, Old Masters and classic modern works returned to the spotlight. It is no coincidence that Klimt, Picasso, or Monet appear among the biggest sales of 2025: these works function as safe anchors in an uncertain economic environment.

New Collectors, New Rules

The contemporary market, meanwhile, has become increasingly fragmented, as highlighted by Artnet News. Among younger, emerging artists, rapid resale activity declined, with many collectors opting to wait rather than invest in yet another overhyped narrative. This did not mean a total collapse: institutionally validated, already canonized contemporary figures—such as Jean-Michel Basquiat or the legacy of Mark Rothko—continued to perform reliably.

One of the most striking shifts in 2025 was the increased visibility of women artists and artists from the Global South. Frida Kahlo’s record-breaking sale was not an isolated event, but part of a longer process in which the market—driven partly by institutional pressure and partly by broader social dynamics—is rethinking who qualifies as a “blue-chip” artist. This is not merely an ideological question, but a very real market consideration: many collectors now see previously undervalued oeuvres as stable long-term investments.

A significant shift also occurred among institutional buyers. Museums, foundations, and corporate collections were far more active in 2025 than in previous years, particularly when it came to works that function as “missing links” within an artist’s oeuvre. This is partly because, within institutions, cultural representation has become not just a moral issue, but a strategic one.

A Redrawn Global Map

At the same time, geographic rebalancing gained momentum. While New York and London remain dominant centres, Hong Kong, Seoul, and Paris played a more pronounced role in 2025. The market is becoming less unipolar, a change reflected not only in auction locations but also in collector taste: alongside the Western canon, increasing attention is being paid to artists who were previously marginalized but are now entering the mainstream both institutionally and commercially.

Technological restructuring also continued. While the hype surrounding NFTs appears to have definitively fizzled out, online auctions and digital viewing rooms have become core market infrastructure. For younger collectors, the entry point is often no longer a marble staircase auction room, but a smartphone screen. This hasn’t fully democratized the market, but it has reshaped the narrative of access.

Stability Above All

However, understanding the 2025 art market requires more than tracking prices and auction records; equally important is the psychological climate in which these transactions took place. Global political uncertainty—ongoing conflicts, a U.S. election year, and sustained inflationary pressure—directly influenced collector decision-making. Art objects continue to function as safe-haven assets, but in 2025 not just anything qualified. The market visibly experienced a crisis of confidence.

This lack of trust was particularly evident in the younger contemporary segment. After years of overheated speculation, many collectors pulled back, and auction houses adopted more cautious estimates. According to the Artnet Intelligence Report, the number of lots failing to meet their low estimates increased significantly in 2025, while the role of guaranteed sales continued to grow. While this mechanism stabilizes the market, it also signals that the romantic notion of the “free bidding war” is increasingly giving way to pre-calculated financial logic.

What Counts as Real Value in Today’s Art Market?

Taken together, 2025 does not simply represent a slowing market, but rather a moment of recalibration. The art market seems to be collectively asking: what truly holds value in a world where economic, social, and technological frameworks are constantly shifting? The answer remains unclear, but one thing is certain: the coming years will bring fewer reckless leaps and more deliberate, long-term decisions.

Overall, 2025 was not a year of spectacular growth, but one of consolidation. Fewer impulsive bids, more strategic choices, and an increasingly sharp distinction between genuinely enduring works and rapidly depreciating trend products. The market did not collapse—it merely reminded us how sensitively it still responds to the state of the world.

The Most Expensive Artworks Sold at Auction in 2025 – Top 10

1. Gustav Klimt – Bildnis Elisabeth Lederer (1914–1916)

$236.4M – Sotheby’s, New York

The undisputed top-tier sale of 2025. Thanks to its historical background and extreme rarity, Klimt’s portrait became an iconic lot, ranking as the second most expensive painting ever sold at auction after Leonardo da Vinci’s Salvator Mundi($450 million, 2017). The work came from the collection of Leonard A. Lauder, heir to Estée Lauder, and its pristine provenance undoubtedly played a major role in the final price. Although unconfirmed, speculation suggests Sheikh Mohamed bin Zayed Al Nahyan, President of the United Arab Emirates, as the buyer—raising the possibility that the painting may enter the newly opened Zayed National Museum in Abu Dhabi. Only one other full-length Klimt portrait remains in private hands.

2. Gustav Klimt – Blumenwiese (1908)

$86M – Sotheby’s, New York

Considered one of Klimt’s most innovative landscapes due to its square format and mosaic-like color fields. Like the top lot, it came from the Lauder Collection—along with the next entry on the list.

3. Gustav Klimt – Waldabhang bei Unterach am Attersee (1916)

$68.3M – Sotheby’s, New York

Despite its significance both within the Lauder Collection (it was the first Klimt acquired) and within the artist’s career (his last surviving landscape), the painting sold below its $70 million estimate—yet still secured a place in last year’s top three.

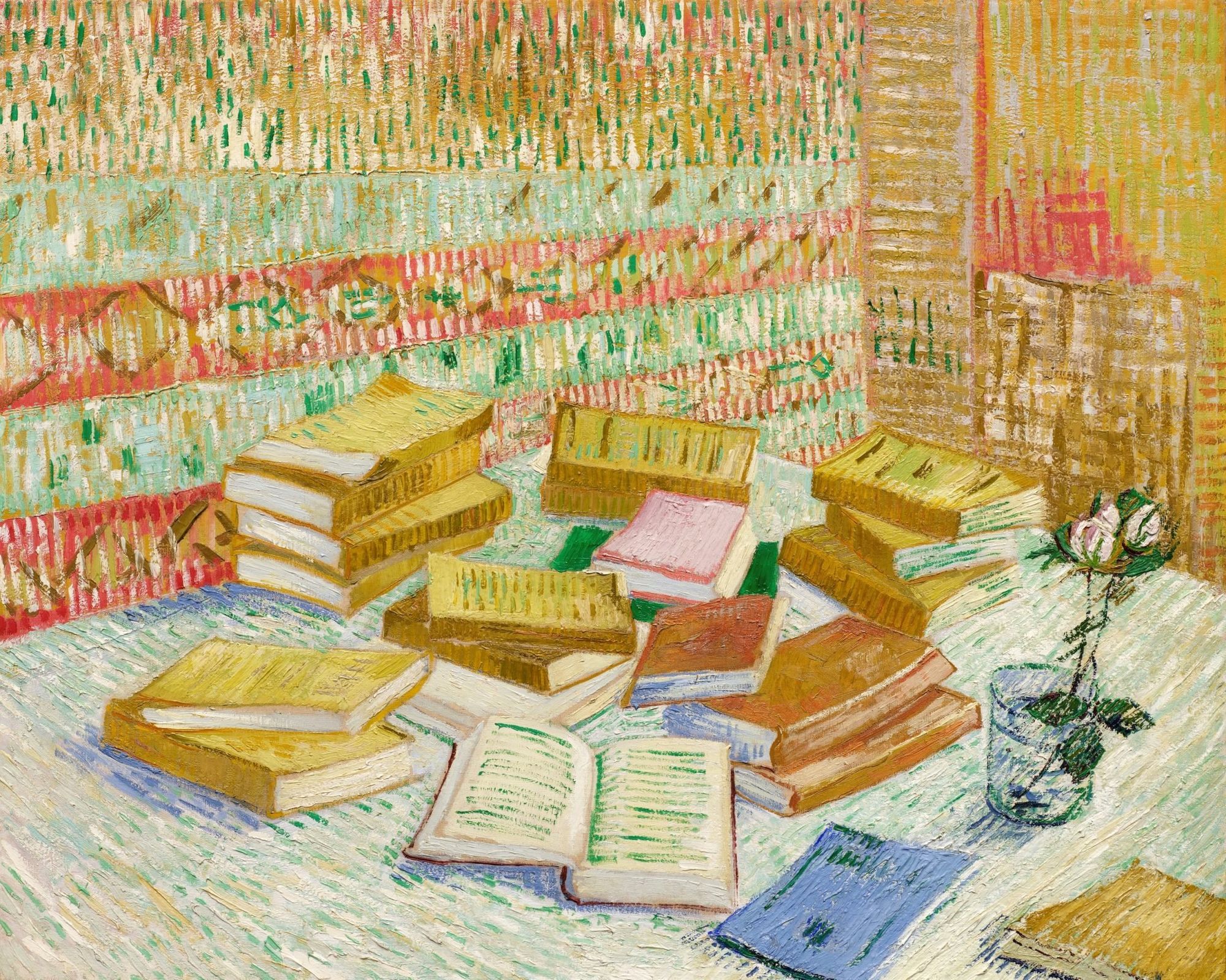

4. Vincent van Gogh – Piles de romans parisiens et roses dans une verre (1887)

$62.7M – Sotheby’s, New York

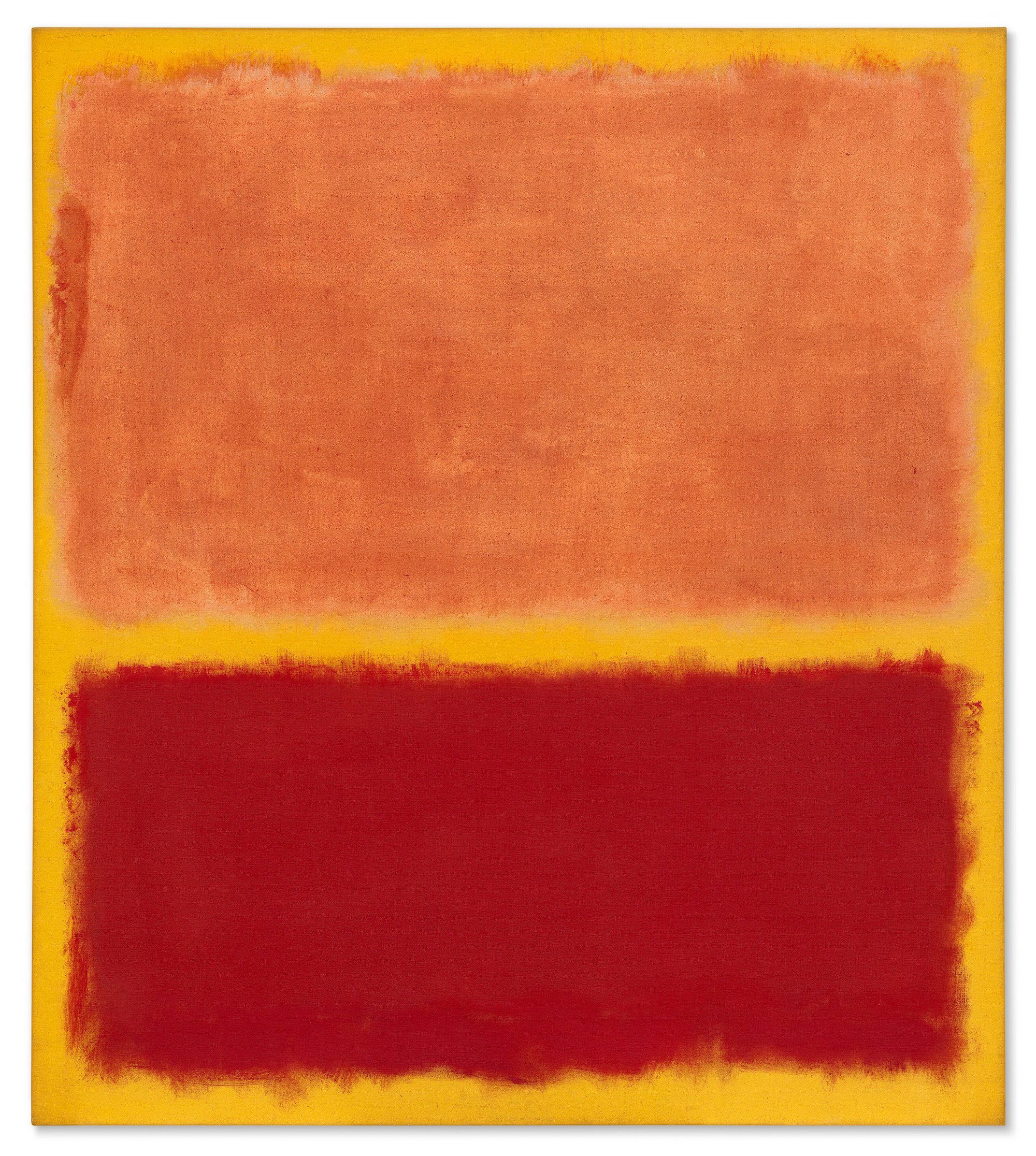

5. Mark Rothko – No. 31 / Yellow Stripe (1958)

$62.2M – Christie’s, New York

6. Frida Kahlo – El sueño / La cama (1940)

$54.7M – Sotheby’s, New York

With this sale, Kahlo surpassed Georgia O’Keeffe to become the highest-priced female artist at auction.

7. Jean-Michel Basquiat – Crowns / Peso Neto (1981)

$48.3M – Sotheby’s, New York

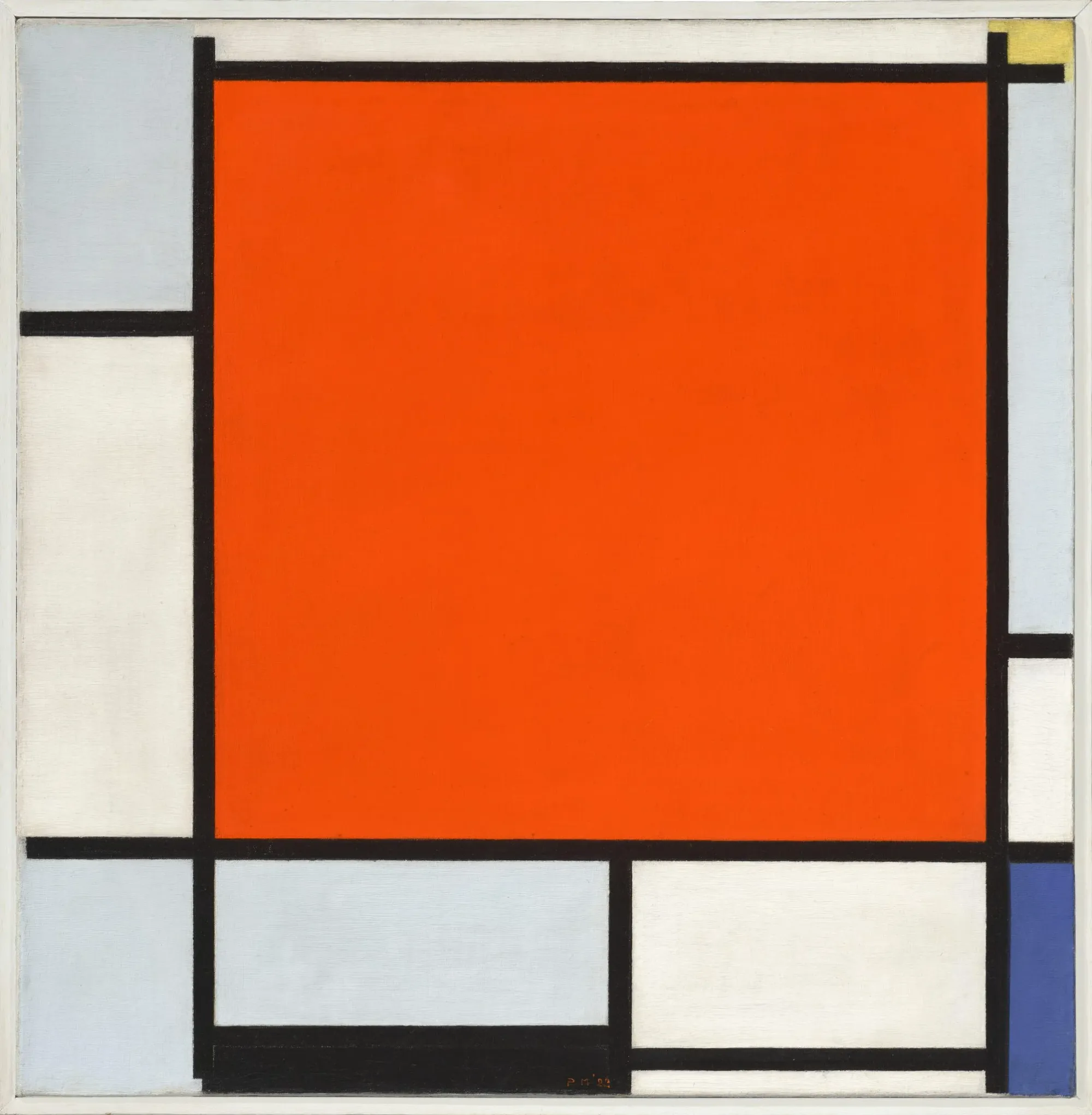

8. Piet Mondrian – Composition with Large Red Plane, Bluish Gray, Yellow, Black and Blue (1922)

$47.6M – Christie’s, New York

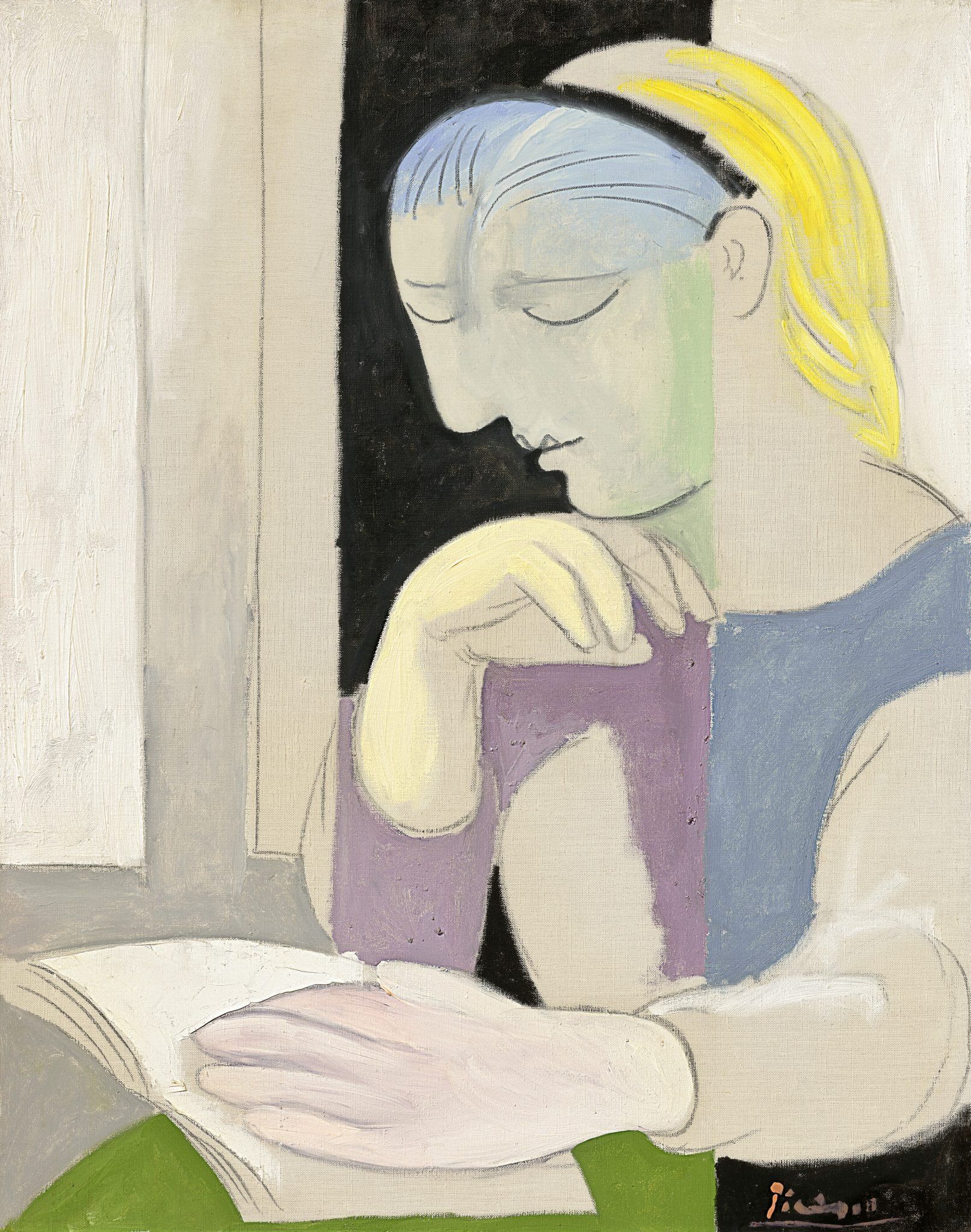

9. Pablo Picasso – La Lecture / Marie-Thérèse (1932)

$45.5M – Christie’s, New York

10. Claude Monet – Nymphéas (1907)

$45.5M – Christie’s, New York

Sources: Art Basel, Wall Street Journal, ArtNet, ArtNet The Intelligence Report, Le Monde, Art News