Central European gas games, regional integration and freezing winter. Poland is becoming independent of Russian gas, building a north-south corridor and managing a complete energy transition. Hungary is signing a long-term contract with Gazprom, while also looking to other sources. Analysis of the region’s energy and gas strategy—Part II.

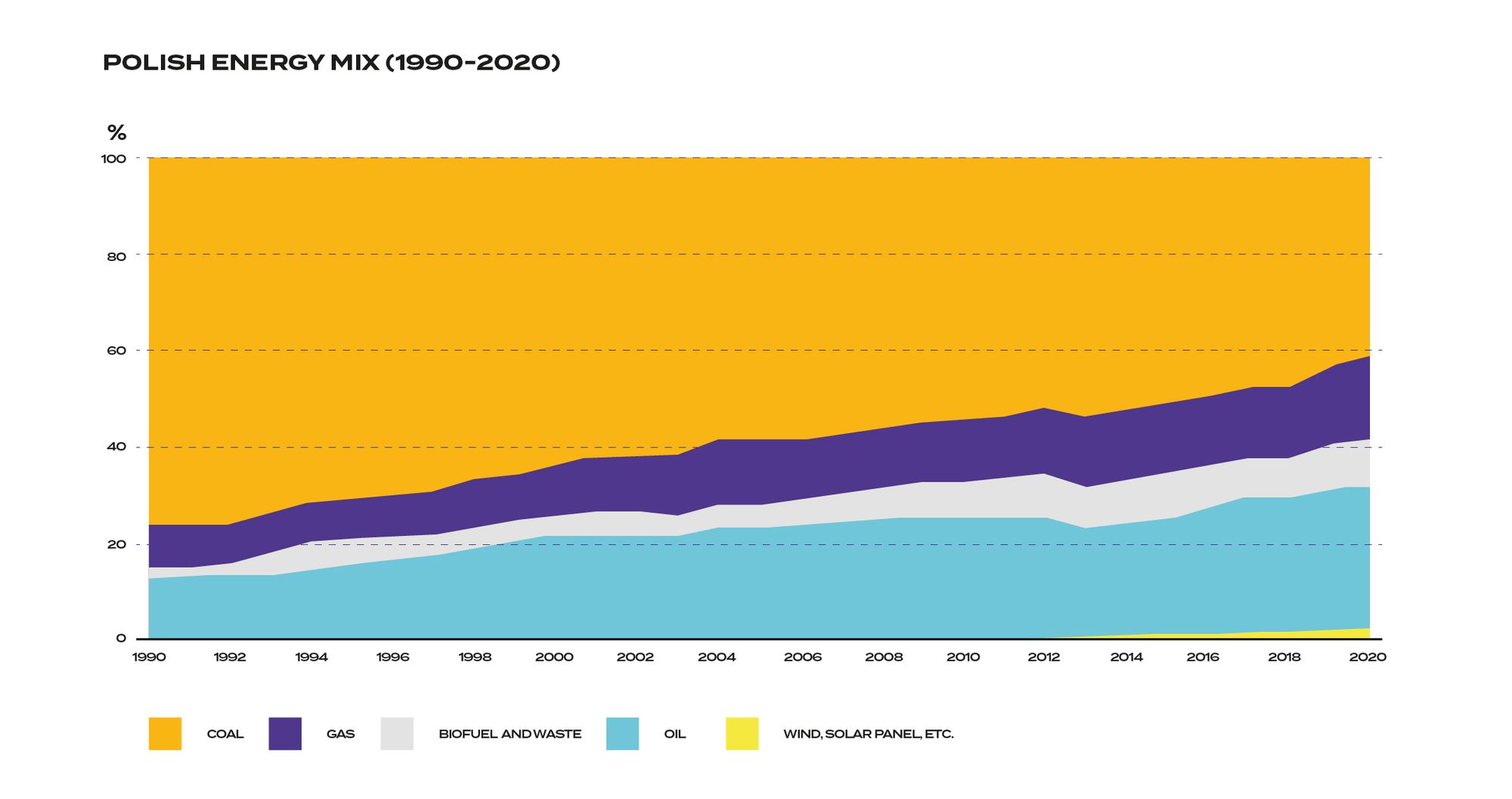

As we wrote in the introduction to Part I: Europe is in panic, gas prices are skyrocketing, Gazprom throws up his hands, people are afraid of rising utility prices, while the Western concept of flexible, market-based gas procurement has failed. From the perspective of Warsaw and Budapest, the picture is quite surreal, because the Central and Eastern European region is on a different path in terms of energy and gas policy. In Part I of our article series, we analyzed the Polish situation, because while Poland is becoming independent of Russian gas, is building a north-south corridor and is managing a complete energy transformation, Hungary is signing a long-term contract with Gazprom, but is also looking for other sources. And the region could become part of an integrated energy system that not only breaks the Russian gas monopoly but could bring about a radical energy transformation.

Gazprom and Rosatom—Budapest’s position

Hungary plays a different role in this equation, as it does not want to become independent from Russia’s Gazprom, with its annual consumption of 10 billion m3, and has recently signed a 15-year contract with the Russian company. The Hungarian position is that the priority is the country’s energy security and the constant security of supply for domestic needs, but instead of achieving this through source diversification, Budapest wants to focus more on infrastructure development. The current contract is a prime example of this, as it has ended the transit of the Ukrainian Brotherhood gas pipeline and Russian gas will enter the country via Serbia, on the new, more modern Balkan section of the TurkStream, which bypasses Ukraine.

The importance of the Balkan routes is paramount for the regional gas market with the Turkish Stream now in operation, and Slovakia, Hungary, Romania and Bulgaria are embarking on a massive €2.6 billion project in the coming years. The Eastring pipeline, due to be completed in 2025, would form a north-south corridor through the four countries involved in the project, bringing in Caspian, Mediterranean, Middle East and Central Asian resources. Eastring would have a capacity of 20 billion m3 per year, which could be expanded to an annual capacity of 40 billion m3 by 2030. The integration of Central Asian producers into European markets could be a very important competitive advantage, as Kazakh and Turkmen companies are Gazprom’s competitors and price competition would certainly not be to the detriment of our region. Hungary also plays a major role in regional network integration, as the Hungarian-Slovak interconnector is currently being expanded in line with Polish developments, and the Hungarian-Slovenian-Italian interconnector, which would connect Southern European markets to the Central and Eastern European network, will start construction in 2026.

In addition to infrastructure developments, there is also progress on the resource side in Hungary, despite the fact that the long-term Russian contract remains a cornerstone of Hungarian gas and energy policy. Budapest has secured one billion cubic meters of gas per year at the Krk Island LNG terminal, half of the terminal’s current capacity. Another interesting aspect could be the LNG terminal in Alexandroupolis, Greece, which could be the gateway to Europe for Egyptian LNG, and the Hungarian government has recently not only tightened its relations with Egypt but also established energy cooperation with the country. And the Greek-Bulgarian interconnector, due to be inaugurated in 2020, will effectively integrate Greek markets into the regional network once the Eastring is completed.

Beyond the gas market, Hungary’s coal-based Mátra Power Plant is also worth mentioning, which will be closed in 2025 to be modernized and continue its mission as a gas-fired power plant. The plant currently accounts for 15 percent of Hungary’s carbon dioxide emissions. The modernization of the Mátra Power Plant will be one of the most significant Hungarian energy projects of the decade, as its technological transformation will be based on four pillars, including the construction of a combined cycle gas turbine power plant and an RDF/biomass-fired unit at the Visonta site. In addition, a solar park will be established on the rehabilitated areas of the two mines, and a pilot plant using clean coal technology as an alternative use of lignite reserves. Such a conversion could reduce emissions by 70 percent and extend the life of the plant by decades, taking advantage of the full life cycle of the facility. The conversion is also of strategic importance because the production of the Mátra power plant must be maintained for the security of supply.

The expansion of the Paks nuclear power plant, which is responsible for 40% of Hungary’s energy supply, is also a strategic issue. The construction of the two new VVER-1200 generation III+ nuclear power units started in 2018, but the modernization and construction work by Rosatom is progressing slowly, with a 2029 delivery date now realistic instead of the 2026 target date. However, Paks 2 is vital, as the country’s long-term energy security can only be ensured by nuclear power considering the state of today’s technologies. It is also important to note that the lifetime of the four 500 MW reactor units at Paks, which have been in operation since 1982, has already been extended once, and that further extensions are currently being discussed, as the first extensions will mean that the operating units will only be 50 years old in 2032-2037, while in many parts of the world they are already running for 60-80 years.

Tandem bike of the region

To sum up, the current Polish energy policy shows a unique path, fostering regional integration and cementing Warsaw’s leading role in the Central and Eastern European region. However, the fast pace of Poland is being closely followed by Budapest, which, whilst advocating a classical and prudent energy policy, undoubtedly plays a major role in regional energy integration due to its geographical location.

Part I of our article series is available here.

Cover photo by Réka Pisla / Hype&Hyper

Unconventional galleries from Eastern Europe | TOP 5

HIGHLIGHTS | Are you lost? It's not your fault!